A booming market only predicted to skyrocket in the future, the healthcare industry is as opportune as it is volatile. Volatile in this sense applying to sales methodology and client/customer interaction. New-age healthcare sales tactics need to cater to a diverse demographic of customers wanting remote, personalized, packageable treatment options. To deliver these services, modern healthcare sales professionals need insight into these trends to leverage them in the patient service delivery pipeline. Thankfully, the healthcare sales professionals at CSS ProSearch have compiled three market-leading 2023 trends within the sales sphere of the healthcare industry below.

CSS ProSearch is an expert sales and marketing recruitment firm delivering talent in the healthcare and life sciences industries among others; reach out here to learn more.

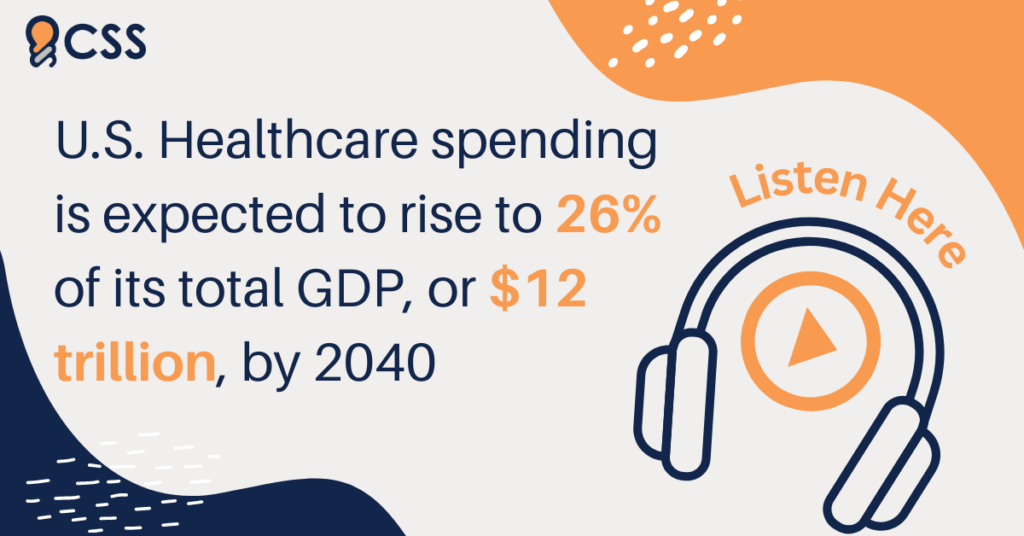

CSS ProSearch proudly offers an audio version of this article for alternative consumption. It is imperative for us to cater to all readers with multiple means of information processing.

Healthcare sales to spike, but only through revolutionized care systems

Healthcare, an industry known for being notoriously slow, is being turned on its head by consumers and patients demanding wholly personalized medical care. The US healthcare expenditure figure sat at 16.8 percent of its total gross domestic product (GDP) in 2019 and is expected to rise to 26 percent, or $12 trillion by 2040 according to Deloitte.

“Remote care, deeper personalization, and the technical assistance of AI and big data are key drivers in this boom, and those lackadaisical enough to gamble on old services risk missing out on their slice of the pie,” says Abby Prince, CSS ProSearch Managing Director.

Monitor, organize, and implement solutions catering to these three healthcare trends below to master your patient pool and deliver exceptional care to all in 2023 and beyond.

Remote Patient Monitoring (RPM)

Spurred on by the global Covid-19 pandemic and subsequently built up for its accessibility, remote patient monitoring (RPM) is a prime service every provider and retailer needs to tap. Insider Intelligence found that the current 20 percent of remote patient monitoring users will balloon to 26.2 percent by 2025, a total of 70.6 million patients.

Remote patient monitoring is a system under the broader telehealth umbrella allowing patients to share real-time medical information, you guessed it, remotely, with their healthcare providers. Global RPM systems will save $1.7 billion in medical expenses globally while expanding necessary care out to markets previously unreachable.

Personalized Healthcare (PHC)

Where RPM makes healthcare directly accessible, personalized healthcare (PHC) makes healthcare directly applicable. Instead of depending on an entirely one-way diagnosis procedure from doctor to patient, PHC capabilities allow the patient to provide answers to their doctor. Low-cost genetic testing kits like 23andMe, whose prices plummeted from the original figure of $999 down to below $100 currently allow patients to send accurate DNA samples to doctors. Doctors then interpret these samples to discern which ailments and diseases a patient is specifically susceptible to. Earlier detection of allergies or vitamin deficiencies increases survival rates astronomically.

Grand View Research found that the 2022 global market value of personalized medicine capped out at $538.93 billion, a figure forecasted to reach $922.72 billion by 2030.

Healthcare personalization specializes further with unbundling

Similarly to how content providers offer different levels of media streaming services, the healthcare industry is venturing into specialized medical packages. These offerings provide unique services to get as close to a one-to-one customer bundle as possible.

These “on-demand” healthcare alternatives allow customers to add and pay for coverage when they need it. Many of these plans are designed with basic co-pays and no deductibles for fundamental coverage.

Urgent care centers are another medical solution falling under the unbundling umbrella. The average cost per visit averages $125-$150 dollars without health insurance; a figure that shoots to $2,032 dollars for a standard insuranceless ER visit.

Partner with CSS ProSearch today to build a team of expert healthcare salespeople with unmatched industry insight

To implement the best sales talent and leverage the most-comprehensive industry data, partner with CSS ProSearch, an organization with an extensive network of executive sales and marketing business professionals. With a focus on healthcare as well as life sciences verticals, CSS ProSearch provides the finest talent and opportunity through seamless recruitment processes. Connect with CSS ProSearch today to attract top sales and marketing talent!